|

|

Citizens for Responsible Government (CRG) is an organization that is meant to promote public discussion and debate on the local tax issues of the day. It functions as a taxpayer watchdog organization to ensure that all government taxing bodies operate responsibly and, when proposing referendums on the ballot, promote such referendums responsibly... |

![]()

WARREN TWP. HIGH SCHOOL DISTRICT’S PROPOSED

TAX INCREASE REFERENDUM :

PRESENTATION OF COMMUNICATIONS AND COMMENTARY

DECEMBER, 2020

Upon just learning late November of a proposed, substantial tax increase proposal coming from our area High School District (voted on in the Spring, 2021, Election), and after receiving the initial newsletter describing various facts related to their proposal, Citizens for Responsible Government (CRG) has realized there were times that only select information was being provided – and pieces needed to be filled in. Only in this way, can citizen/taxpayers make a fully educated – and informed – decision.

The below are the correspondences between Ken Arnold (Member and Co-Founder of Citizens for Responsible Government) and members of the Warren Twp. High School District Administration - in chronological order from least recent down to most recent communications. When required for further elaboration, one will find [within red colored brackets] additional information and commentary to complete the picture.

In the spirit of “Promoting Open Debate and Public Information” (CRG’s motto) we fill in the missing pieces so that informed voting can occur. Our organization either recommends to our fellow citizens that, after full information and analysis, we are neutral on such referendums…or we oppose the current adoption of any particular referendum. IN THIS CASE, AND FOR THE SPRING, 2021 ELECTION, WE RECOMMEND CITIZENS VOTE AGAINST SUCH PROPOSAL.

INITIAL REQUEST FOR FURTHER INFORMATION ON REFERENDUM . . .

Dear Superintendent and Board Members,

I, and all other taxpayers, cannot adequately evaluate or even hope to support your proposed referendum due to several important factors. To name some:

1) There's a "mad rush", in your initial public meeting on this issue, so close to Thanksgiving...and now even potentially adopting a move to place such on the ballot less than two weeks later -- all during the Thanksgiving Holiday time and earlier than your newsletter even outlined. (If this was to be fair, this public information and feedback should have been started 45-60 days ago. Now it just badly appears the school doesn't WANT such from the public.)

2) The flier sent out (coincidentally, right DURING the Thanksgiving Holiday period) clearly (at best) gave half information in numerous areas that is required by taxpayers to fully evaluate the need and situation. Whether it was poor thought thru of what WOULD be needed information by the taxpayers -- or deliberate "card stacking" technique to only give the information which makes a tax increase most attractive -- I will not comment on. But just two examples are: 1) You give the increase of 60 cents -- but you failed to tell the taxpayer what your school’s total tax rate collected is and what PERCENTAGE increase this would represent to their total Warren Twp. H.S. tax bill; and, 2) You give staff cuts over the five prior years as well as the projected cuts without this tax increase over the NEXT three years -- but you failed to give the commensurate DECLINES in student enrollment that have occurred...and what the demographer, under the "most likely" scenario, projects over those next three years will be the student decline. These and others I list below -- and under FOIA law I hereby request that this information be provided to me as early as possible. Frankly, I'd respectfully also request that they also be provided to all taxpayer/residents. [Citizens for Responsible Government (CRG) merely requires FULL and open information and debate on the issues. When such is not provided citizens, we work at "filling in the blanks". I'd far rather the school do this education than CRG...because it doesn't make the school look good nor it's requests. I hope that will be the case here...].

Anyway, I do not know the deadline to place things on next year's ballot, but I would urge you to inform the citizen/taxpayers - post haste- of many of the answers to these questions...get their feedback...and THEN decide. Deciding only two days after many even get back from their Thanksgiving vacations is, by definition, rash and therefore unfair.

Again: Under the Freedom of Information Act (FOIA) and as a resident/taxpayer of the Woodland School District, I respectfully ask for the prompt provision of the following information items:

1) What is the total current limiting rate tax to which, then, this potential 60 cent increase would be attached to? (And what PERCENTAGE tax increase does that then represent?)

2) Over the past five years referenced in the Newsletter relative to positions eliminated...and over the future three years projected for staff eliminations, what are the total Woodland student populations in this prior five year ago, and future three years in the future (via your "most likely" demographer projections) that we are talking about. (Taxpayers would SURELY want to know the proportionality of student declines to staff declines...and you should communicate that to the public yourself).

3) What was the most recent referendum that went to taxpayers calling for increased spending by Woodland School (it was NOT your technical reference to OPERATING fund referendums...I am asking for ANY referendum. From memory, I believe the most recent one - just a few years ago - was asking taxpayers for more money on parking lot repair/expansion and some other items, no?. (Taxpayers what to know when they were LAST ASKED FOR MORE...what technical account it was from is of little concern and attention from them...)

4) Your newsletter gave various comparators such as funding per pupil, Student to Teacher Ratio, and others. However: It failed to include some of the School Districts CLOSEST to Woodland. Please provide me with the comparable data for: a) Waukegan H.S. School District; and, b) North Chicago H.S. District. (These, too, should have been included to the public...).

5) Your newsletter only gave the District's tax rate comparison to the Grayslake 127 should the 60 cent increase occur. BUT EVERYONE KNOWS THAT'S ONE OF THE HIGHEST AROUND! :) For balance, please provide the similar tax rate comparison relative to the other Comparator Districts, along with the added Waukegan and North Chicago School districts to give a fully honest and fair assessment of that issue. (Again: This should also be conveyed by the District, not I and CRG, for complete and transparent proposal evaluation...).

6) For the prior school year, current school year, and the next school year (i.e. 2021-2022), what are the components of total compensation that were previously negotiated within the teachers union contract. Please include ALL components - include the step rate, thank you.

SOME TRULY HELPFUL SUGGESTIONS...

I, myself, have been directly involved in various areas of school finance...even being one year on the first "Finance Committee" of Woodland School a number of years ago working, with teachers, administration, and other members of the general public to creatively seek ways of operating more efficiently and therefore at less cost to the taxpayers. Such efforts were a success (even though I myself identified or created savings that was 3X what the committee ultimate adopted).

Anyway, I myself constructively pose to Warren Township H.S. District the following (the first one of which apparently has never been considered apparently...but is the FIRST thing that taxpayers would insist be pushed as they themselves are being pushed for the same thing). These are:

1) RENEGOTIATE THE TEACHERS CONTRACT

Warren Twp. average pay for teachers (especially when considering it's approx. only 9 months of work per year - not 12 like most taxpayers) is CLEARLY very high compared to that who they get their money from (i.e. the taxpayer). The Board has kinda dug their own hole... Many firms, like most recently airline employees, are being successfully asked for REDUCTIONS in their compensation given the economy and the COVID-19 situation. Warren should be no different than the taxpayers...and renegotiate their contracts. They were already out of sinc with those providing these monies...now even MORE obscenely so. A 5 percent reduction, for at least three years, would not at all be out of the question...

2) Moving from an 8 to a 7 period day may not be "the end of the world"! Why cannot each class period be commensurately extended in time...and then only meet, say, Monday/Wednesday/Friday as another class with normally lesser credit hours then gets the Tuesday and Thursday slot of time? Thus, both classes are still offered...it's just that one no longer attends the first class five days a week...only three days a week but has more time per day.

3) Student fees, years ago, was something I and CRG suggested be implemented. That said, sometimes - depending on the magnitude of a student's activities - the level that's been asked has NOT been high enough. Additionally and most particularly, there never was a "two tier" Registration or Activity Fees...one size was fitting all. Consideration SHOULD be made to raising such fees either by: 1) Gauging the fee on how many chargeable activities the particular student will specify they wish to participate in and/or 2) Their economic ability to pay (specifically those who qualify for the federal school lunch program pay X...and all others pay a higher Y...). There is nothing wrong with employing one, or both of these basis for determining what each student must contribute to the cost of these activities.

4) Like student activities in point #3 above, ADVANCE PLACEMENT CLASSES can also be slated for material fee increases. In this case, and from my dated information, I remember such classes were just a small fraction of the cost of a traditional college class to which these classes allow one to get credit for. So a study of such college cost, versus what Warren H.S. cost would be, is in order...and a policy developed to bench such charge on an approx. percentage of what student's would typically be charged by Universities. I don't know without further studying it, but it's likely a charge equaling 30-40% of the cost within college would easily be deemed appropriate. And again, if one is somehow uncomfortable with that level - or higher even...one can employ the same, two tier concept based upon a student's economic status to soften such charge for lower income families.

5) Especially after the most recent Warren H.S. referendum (which was NOT 20 years ago), PARKING FEES are way too low. Under the rationale of: a) Paying more toward the ACTUAL cost of building/maintaining these lots, b) The need to presently generate more revenue; and, c) The ecology in discouraging needless auto driving when bus driving is provided for (and their costs don't change because a few more student ride), one can increase the parking fees materially. Again: Consideration can there, too, be made based upon the student's economic circumstance per the Federal School Lunch Program...but I'd contend that's not necessary since even lower income student who don't need to drive STILL don't need to drive...

Conclusion

Warren High School's current labor costs and the supposed needs now arise from way too many past and current years of "giving away the store" in teacher union negotiations. Between all of the contract's annual increases (including step rate) teachers have honestly taken TOO much of the bread of taxpayers who they should always get their cues from. Because of our economy and the whole Virus crises (which economically I'd project won't be over for at least the next two years), SURELY both economies of operations and modest reduction in labor costs are in order. Unfortunately, the latter is unaddressed, it appears, in the brochure you recently sent out.

I hope that citizen/taxpayers - when given all relevant information I've alluded to above - will make a wise decision on this present referendum (either way). However: I must tell you that without this information being provided them, I and CRG will surely OPPOSE the present adoption of such initiative. Regardless, it is clear that MORE work at cost reductions, and perhaps some of the revenue enhancements I have shared above, are in order...and these should well cover any needs without likely asking the taxpayers for more...AFTER these initiatives are done. Raising taxes should be - now more than ever - the LAST resort...not an easy resort.

I look forward to you both providing the above requested information items as soon as possible to me, as well as you (hopefully) fully educating the voters on them as well. I and CRG are not consistently opposed to proposals (we in some cases have taken a neutral position being satisfied that the taxpayer/voters HAVE all relevant information...and we respect their ultimate decision then). But where such information and transparent public information is lacking, we have strived to fill that void. I look forward to that not at all being required here...and thank you for that on behalf of the residents and taxpayers of the Warren High School District.

Sincerely,

Kenneth Arnold

Gurnee, IL

WTHS ADMINISTRATION’S REPLY TO KEN ARNOLD THEN . . .

NOTE: CRG has added further insights and commentary [in red colored brackets] where required to completely cover the respective subjects or comment on what is stated.

Dear Mr. Arnold:

Thank you for writing to Warren Township High School District 121 ("District") with your request for information pursuant to the Illinois Freedom of Information Act ("FOIA"), 5 ILCS 140/1 et seq., emailed on November 30, 2020 at 8:54 p.m., and received December I, 2020, Your request is for the following records:

"Under the Freedom of Information Act (FOIA) and as a resident/taxpayer of the Woodland School District, I respectfully ask for the prompt provision of the following information items:

I) What is the total current limiting rate tax to which, then, this potential 60 cent increase would be attached to? (And what PERCENTAGE tax increase does that then represent?)

2) Over the past five years referenced in the Newsletter relative to positions eliminated...and over the future three years projected for staff eliminations, what are the total Woodland student populations in this prior five year ago, and future three years in the future (via your "most likely" demographer projections) that we are talking about. (Taxpayers would SURELY want to know the proportionality of student declines to staff declines...and you should communicate that to the public yourself).

3) What was the most recent referendum that went to taxpayers calling for increased spending by Woodland School (it was NOT your technical reference to OPERATING fund referendums...l am asking for ANY referendum. From memory, I believe the most recent one - just a few years ago - was asking taxpayers for more money on parking lot repair/expansion and some other items, no?. (Taxpayers what to know when they were LAST ASKED FOR MORE...what technical account it was from is of little concern and attention from them...)

4) Your newsletter gave various comparators such as funding per pupil, Student to Teacher Ratio, and others. However: It failed to include some of the School Districts CLOSEST to Woodland. Please provide me with the comparable data for: a) Waukegan H.S. School District; and, b) North Chicago H.S. District. (These, too, should have been included to the public...).

5) Your newsletter only gave the District's tax rate comparison to the Grayslake 127 should the 60 cent increase occur. BUT EVERYONE KNOWS THAT'S ONE OF THE HIGHEST AROUND! :) For balance, please provide the similar tax rate comparison relative to the other Comparator Districts, along with the added Waukegan and North Chicago School districts to give a fully honest and fair assessment of that issue. (Again: This should also be conveyed by the District, not I and CRG, for complete and transparent proposal evaluation...).

6) For the prior school year, current school year, and the next school year (i.e 2021-2022), what are the components of total compensation that were previously negotiated within the teachers union contract. Please include ALL components - include the step rate, thank you,"

On December 2, 2020, at 6:37 p.m. you emailed us to clarify that you were referring to Warren Township High School District 121 rather than Woodland School District.

In response to your request, and as you noted, it is important to note that Warren Township High School District 121 is a single high school district with two campuses and is an entirely separate entity than our sender districts. We have interpreted your requests to be referring to WTHS and not Woodland, and therefore we are providing information related to WTHS rather than Woodland where applicable. Additionally, please note that FOIA only provides access to existing records; it does not require a public body to answer questions or create new records. See 5 ILCS 140/3.3; Kenyon v, Garrels, 184 Ill. App, 3d 28, 32 (4 th Dist. 1989); see also Chicago Tribune Co. v. Dept. of Financial and Professional Regulation, 2014 IL App. (4th) 130427 1133 ("A request to inspect or copy must reasonably identify a public record and not general data, information, or statistics."). While we reserve the right to decline to answer such questions in response to future requests, documents and/or website links responsive to your requests are provided below and in some instances, a narrative response is offered,

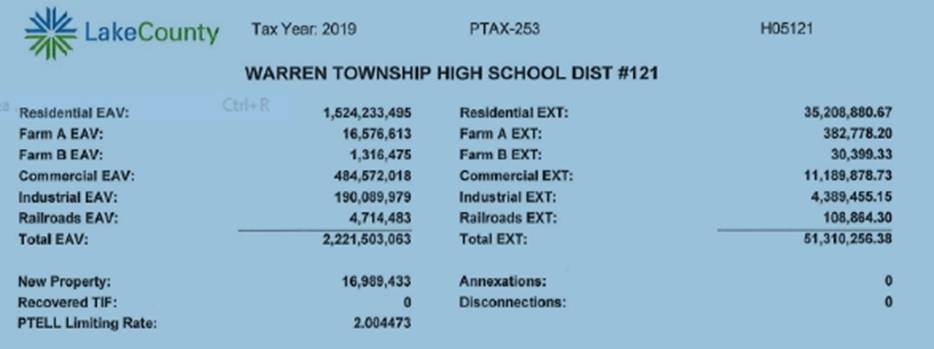

District Response #1 - See enclosed 2019 tax extension report. Note that the 2020 limiting rate is currently unknown. [Never answered the clear questions posed of what the current rate is…and what this 60 cent proposal would represent in percentage increase! Gave a technical report as an attachment with no guidance to obfuscate matters that were two, simple questions. Can only surmise they do not wish to advertise the magnitude this tax increase represents. CRG DID find one example of the dollar impact (not in what was given taxpayers; but, from a meeting presentation): The tax increase would put a very material, $600 increase in taxes per year on each $300K home in the District!)]

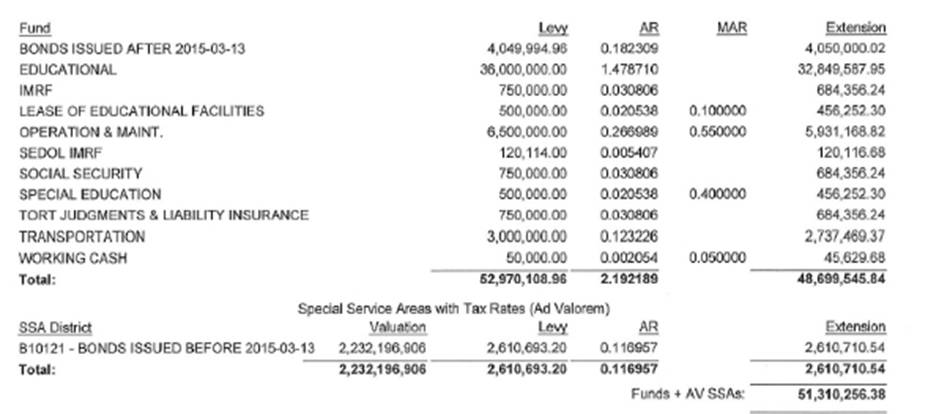

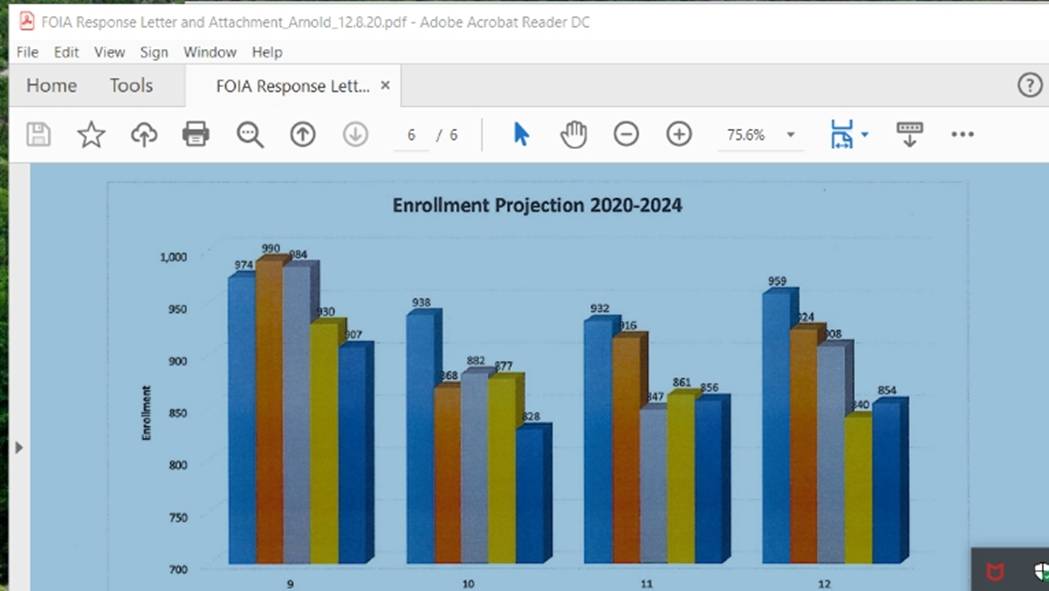

District Response #2 - Attached are two charts representing Warren Township High School District 121 's projected enrollment numbers. Please note that WTHS provided information about enrollment and staffing trends in an August 2018 community-wide newsletter. However, we are happy to update the information on our website to reflect this information.

[District’s mailed November newsletter talked in terms of staff reductions if the tax increase was not made…they never revealed that STUDENT NUMBERS are projected to decline. In point of fact: 42 of the 46 staff reductions, if related in proportion to the decline in students in the next three school years, would be attributed to these declines in the student population! These are not catastrophies…they’re relatively proportional to the “decline of business” the school will have! The District says that the tax increase would “protect” 33 teacher and staff positions in the 2022/23 school year. To which taxpayers should ask, relative to the student population projected: “WHY protect them?”]

District Response #3 - The historical referendum information provided in the fact sheets, newsletters and webinars is regarding operating tax rate increases, which is the District's current priority. The last referendum presented to the community and approved by the voters was November 4, 2008 which was a $30 million school building bond issue for the Almond Campus and designated for 10 new classrooms, renovating storage space into classrooms, expansion of the cafeteria into the adjacent fine arts theater and construction of a new fine arts facility onto the existing Almond Campus. Money was also used for improvements in the Almond and O'Plaine parking lots for traffic circulation and student safety and improved access roads at the Almond Campus and construction of a District Officer Please note that a school building bonds referendum can only apply to construction or physical changes as specified in each referendum question and cannot be used for operating needs. This historical information about school building bonds was provided in a community„wide newsletter in August 2014. However, we are happy to update the information on our website to reflect this information.

[The District’s November Newsletter gave taxpayers the inaccurate impression that it’s been 20 years since the last time they were asked for even more taxes. They relied on TECHNICALLY speaking about “operating funds” – one of many accounts the school has. But taxpayers don’t know, and honestly don’t care about the Transportation Fund, the Operating Fund, and the several other fund accounts that their tax money is internally divided up into. To the TAXPAYER, all they know and care about is: “When was the last time Warren Twp. High School asked for more money from me?” The REAL answer is not 20 years – but just 12 years ago…]

District Response #4 - Waukegan CUSD 60 and North Chicago CUSD 187 are not high school districts, they are unit school districts. Warren Township High School District 121 is one high school district with two campuses. Comparable data of Lake County high school districts has been provided in fact sheets, newsletters and webinars as these districts, under the State of Illinois School Code parameters, are structured and organized with comparable operating expenditures, whereas unit districts are not. Having said that, nearby local unit districts include: Waukegan District 60, Round Lake District 116, North Chicago District 187, Wauconda District 118 and Lake Zurich District 95. The District does not possess any comparable data to Lake County high school districts for these districts at this time.

District Response #5 - WTHS hosted three community webinars. Links to the webinars with a PowerPoint presentation can be found on the District's website at https://www.d121.org/Page/745. Specifically, at approximately 10 minutes into the webinars is information about tax rate comparisons relative to the other Lake County high school districts. Unit districts are not included in the comparisons as their organizational and operating expenses are not comparable to Lake County high school districts.

[The District’s answers to Ken Arnold’s questions #4 and #5 are fair answers. It appears the data breakout in these consolidated school districts are either not existing or not available at this time. Perhaps taxpayers can write their State Representative and Senator urging them to require such breakout as ALL area High Schools should be able to compare themselves to one another. Given some of their geographic proximity to Warren, some of these would be relevant to such analysis.]

District Response #6 - Warren's Collective Bargaining Agreement can be found on our website at:

https:Lli102214492.schoolwires.net/cms/lib/IL02214492/Centricity/domain/121/collect ive%20bargaining%20agreement/WRN 2018-2023 CBA v.8 Final Redacted.pdf Specifically, pages 76, 77 and 78 are salary schedules responsive to your request.

[The District’s answer was not fully responsive to the specific question – but merely pointed to the Labor Contract to which not all District Personnel are under. But it is a fact, and very fair to say, that within this Labor Contract are annual increases to personnel which – even before the current economic crises – FAR exceeded the typical annual increases that those who supply the District’s funds (i.e. the taxpayers) were receiving. Now, they could be termed highly insensitive to taxpayers and unrealistic given the state of the economy! (Example: “Classified Staff” over this present three year period are averaging a 4.66% compensation increase per year.

Compensation is a very large driver of the overall District’s Operating Costs. If major airline pilots are presently doing modest compensation reductions in these times, why can’t the District demand a renegotiation of their contracts to reflect the conditions we taxpayers find ourselves in regarding annual increases…if we even now HAVE a job giving any compensation! A good question, indeed… In just a few short years, this situation of overly generous compensation and increases will drive deficits from the present $2.5 million dollars to $6.9 million in deficit PER YEAR! This is unsustainable…and it is not primarily a revenue problem – it’s a SPENDING problem.]

Although we have not intended to deny any part of your request, you may have a right to have this response reviewed by the Public Access Counselor (PAC) at the Office of the Illinois Attorney General. 5 ILCS 140/9.5 You can file your Request for Review with the PAC by writing to:

Public Access Counselor

Office of the Attorney General

500 South 2nd Street

Springfield, Illinois 62706

Fax: 217-782-1396

E-mail: publicaccess@atgstate.il.us

If you choose to file a Request for Review with the PAC, you must do so within 60 calendar days of the date of this letter. 5 ILCS 140/9.5 (a). Please note that you must include a copy of your original FOIA request and this letter when filing a Request for Review with the PAC. You also have the right to seek judicial review of any denial by filing a lawsuit in the State circuit court. 5 ILCS 140/1 L

As the District's FOIA Officer, I am responsible for the District's response to your request. This letter and enclosed information is intended to be fully responsive to your specific request. If I have misunderstood your request in any way, please clarify your request in writing to me.

Sincerely,

Jeanne Love

Executive Assistant to the Superintendent and Board Clerk

Freedom of Information Officer

[CRG NOTE: Attachments follow. Please forgive the formatting due to .pdf to word conversion…]

GRADE

KEN ARNOLD's FOLLOW ON REQUEST FROM DISTRICT'S REPLY ABOVE

Dear Ms. Love and Mr. Ahlgrim,

It is with appreciation that we respond and say thank you for your timely response. Much has been answered sufficiently per the original FOIA request sent...and this additional information will prove helpful to conveying needed, accurate, and relevant information to taxpayers who, already, are starting to ask about this matter. It is unfortunate that this whole issue could not have started in community discussions and debate before 1-2 days before the start of the Holidays (i.e. Thanksgiving)...and like so many others, these are busier times than normal. That is why - only now - I have been able to reply here.

FOLLOW-ON FOIA REQUESTS TO CLARIFY AND ANSWER MY QUESTIONS

There is one - most important remaining question not answered from my original inquiries which I appreciate presently. I had asked (in my point #1) "What is the total current limiting rate tax to which, then, this potential 60 cent increase would be attached to? (And what PERCENTAGE tax increase does that then represent?)" I did not get a confirming and direct answer to those two points...I was merely given a very technical sheet, the Tax Extension Report. Not wishing to have to go thru extensive validation that I am using the right data (which we ALWAYS strive for before the public), would you please clarify and confirm my initial understanding here?

Specifically: Would the 60 cents be added to the total "AR" of 2.192189 to yield a total of 2.792189 -- or a 27.4 percent increase in this tax rate? Please correct this if my initial read is off (others know these technical tax details better than I do...). Thank you.

Also my single additional information request is: Your Zoom presentations had your District outline that the School District is limited to 2% annual increases to it's local property taxes...yet your total expenses annually increase "far higher". Precisely WHAT have been the annual total district expense increases? Please provide the year to year percent increases over the past two, and current school year relative to the prior school year, thank you, so we know what "far higher" annual total expenses have been.

On a last note: Efforts such as mine are as much to work WITH the school as it is to also strive for full information and public debate on such tax issues before the public. In addition to several notations in your reply where you say you would be more than happy to do certain things (much appreciated)...I say, "Please do" to each. This, and other suggestions, I hope the High School District truly takes to heart.

CONCLUSION

Thank you for getting back to me sometime this week to fully answer my original question and confirming my initial understandings as to the rate and the rate increase -- as well as the nailing down of just what "far higher" annual total expense increases really are for WTHS. This will be most helpful as I, Citizens for Responsible Government (CRG), and the general public evaluate things and ensure that full and public information and debate is had within our community before deciding this very important issue of tax levels and needs.

I look forward to your timely response, Ms. Love.

Kenneth Arnold

Gurnee, IL

WTHS DISTRICT'S REPLY TO KEN ARNOLD'S ABOVE,

FOLLOW ON INQUIRIES...

Dear Mr. Arnold:

Thank you for writing to Warren Township High School District 121 ("District") with your request for information pursuant to the Illinois Freedom of Information Act ("FOIA"),5 ILCS 140/1 et seq., emailed on December 20, 2020 at 5:10 p.m., and received December 21, 2020. Your request is for the following records:

"Would the 60 cents be added to the total "AR” of 2.192189 to yield a total of 2.792189 - or a 27.4 percent increase in this tax rate? Please correct this if my initial read is off (others know these technical tax details better than I do...)

“Also my single additional information request is: Your Zoom presentations had your District outline that the School District is limited to 2% annual increases to it’s local property taxes...yet your total expenses annually increase "far higher". Precisely WHAT have been the annual total district expense increases? Please provide the year to year percent increases over the past two, and current school year relative to the prior school year, thank you, so we know what "far higher" annual total expenses have been."

To the extent responsive records exist, your request is granted. While FOIA does not require a public body to answer questions, we are willing to do so below without waiving any rights.

District Response #1 - The 60-cent amount is not yet fixed. Please contact us after January 12th for the final amount of any proposed increase. That said, within the 2019 tax extension report, a potential 60-cent increase would be added to the "PTELL Limiting Rate" figure of 2.004473. At this time, the District declines to state this potential change in terms of a percentage increase in tax rates due to the potential for confusion.

[ Sadly, the WTHS District's answer to neither confirm that the 60 cent rate increase represents a 29.9% increase in the school's tax rate to property holders - or to correct such specification - is, honestly, an insult to taxpayers! If they will not tell the public the MAGNITUDE of any proposed tax increase (in percentage increase from their present tax rate, they CERTAINLY do not deserve to get it! Moreover: To say that giving taxpayer's the percentage increase to their taxes that their proposal represents - and to insult taxpayers in saying that such information would be "confusing" to them, is an insult -- in all honesty. With what information has been now provided by CRG's inquiries, they propose a 29.9 percent increase in these taxes to the several thousand in property taxes per year taxpayers are typically already paying to the District!

Of final note is that the newsletter mailing given area taxpayers never couched their proposal as anything but a definite and firm proposal. Readers should note they now couch it as tentative... ]

District Response #2 - Although the District's annual financial reports are posted online (https://www.dl21.org/domain /121L they include the District’s budget cuts and cost control measures and, thus, do not reflect the expenditure increases. The District does have an internal 5-year budget forecasting document, but it is exempt under FOIA Section 7(l)(f), which covers preliminary drafts, notes, recommendations, memoranda or other records in which opinions are expressed or policies or actions are formulated. See 5 ILCS140/7 (l)(f); see Harwood v. McDonough, 344 Ill. App. 3d 242. 247 (1st Dist. 2003).

That being said, within the District’s projections, the tentative projected annual overall revenue increases are anticipated at approximately 2.1%, and the District's tentative projected annual overall expenditure increases (in the absence of position reductions) are at approximately 3.4%. Additional specifics will be discussed at an upcoming remote Finance Committee meeting on Tuesday, January 19 at 5:30 p.m., and this link will be posted on the District website as the meeting date draws nearer.

[ CRG, with the Response #2 given by the District, can only surmise a deliberate obfuscation of the question posed to them as to their recent past and present total District expenses and their year to year increases (a pretty simple question and request...). They go off and point to annual financial reports -- but then immediately say they're not accurate. Then they never outline what IS accurate figures (let alone simply answer the question). CRG, however, DOES know their year to year spending increases have been very material over recent years. In fact: On a going forward basis, their own presentations show a current annual deficit of $2.5 million PER YEAR quickly going to an $6.9 million per year deficit IN JUST THE NEXT FEW YEARS -- and that despite student population declining!

WTHS District has been on this path, with overly generous and unsustainable teacher's union contracts for a number of years...and they have previously, and even with this current proposal, failed to address that "Elephant in the Room" (i.e. renegotiating such contract...NOW). ]

You may have a right to have this response reviewed by the Public Access Counselor (PAC) at the Office of the Illinois Attorney General. 5 ILCS 140/9.5(a). You can file your Request for Review with the PAC by writing to:

Public Access Counselor

Office of the Attorney General

500 South 2nd Street

Springfield, Illinois 62706

Fax: 217-782-1396

E-mail: publicaccess@atg.state.il.us

If you choose to file a Request for Review with the PAC, you must do so within 60 calendar days of the date of this letter. 5 ILCS 140/9.5(a). Please note that you must include a copy of your original F01A request and this letter when filing a Request for Review with the PAC. You also have the right to seek judicial review of any denial by filing a lawsuit in the State circuit court. 5 ILCS 140/11.

As the District’s FOIA Officer, I am responsible for the District’s response to your request. This letter and enclosed/linked information is intended to be fully responsive to your specific request. If I have misunderstood your request in any way, please clarify your request in writing to me.

Sincerely,

Jeanne Love

Executive Assistant to the Superintendent and Board Clerk

Freedom of Information Officer

ADDITIONAL POINTS AND CONSIDERATIONS . . .

Citizens for Responsible Government (CRG) believes that between the communications done by the Warren Twp. High School District, and the completion of information and considerations by us here (some of which was conveniently not mentioned or covered in the school district’s materials) voters will now have a more complete and accurate picture for they to decide how to vote on this issue.

Our organization recommends you vote AGAINST this present tax increase proposal. Unfortunately, this taxing body obviously considers the material compensation levels, and annual increases (Example: Classified Staff (non-teachers) averaging a 4.66% per year increase now and over the next two school years) as “sacred cows” to never be addressed and never to be outlined to taxpayers. So too their staffing levels...DESPITE declining student enrollments. We believe that EVERY item of cost savings needs to be reviewed BEFORE asking taxpayers for more money. Tax increases are the LAST RESORT – not the first resort…especially in these times.

Until WTHS District makes concerted efforts to RENEGOTIATE their contracts to address “the Elephant in the room” and largest expense item (i.e. Compensation and Benefits), this referendum deserves to be voted down as is. The Teachers, and Administration, need to “go back to the drawing board"…especially in light of today’s economic environment relative to the pandemic. If major airline pilots and others are making wage concessions in this environment…if taxpayers are so massively getting their hours cut or getting only 1-2% annual increases…or even losing their jobs altogether, SURELY Teachers and Staff need to make some reasonable concessions in these times – and do so NOW.

Failure to address the above matter is irresponsible on the part of both the Administration and Teachers at Warren Twp. High School. Per their own depictions, it could drive their annual deficits from approx. 2 1/2 Million to approx. $6 1/2 Million PER YEAR in just a few short years. Until such unrealistically generous compensation and increases are materially addressed, any referendum deserves a “No” vote in our opinion.

We respect the ultimate decision of our friends and neighbors in the Gurnee area. But they must have a full and fair picture of the issues at hand for all parties to be accepting…and know it is “the will of the people”. With all of the above, additional information items – we believe voters can make such informed choice for our community!

Sincerely,

Ken Arnold, Co-Founder

Citizens for Responsible Government (CRG)

Gurnee, IL

P.S. We have established a Group on www.NextDoor.com for our friends and neighbors to keep informed on this important tax issue. Also: Feel free to join our organization there and perhaps modestly contribute monies toward these causes of informing citizens and keeping government taxing bodies honest, efficient, and responsible to the citizens. Thank you.

*** END OF WTHS TAX PROPOSAL INFORMATION ***

===============================================================

Part of responsibility when proposing referendums is the following two concepts:

1) All relevant and material information IS provided to the voting public. No "lies by omission" or outright misstatements are to be tolerated. If performed by the taxing body, CRG will "come off the porch" and fill in the blanks as to their tax increase proposition(s).

2) That coming to the voters for tax INCREASES is the very last resort after the taxing body has made full, good faith efforts in responsibly operating their organizations. Just because of free spending, and resultant deficits, there is no reason to say that a taxing body "needs the money". Government should spend our money no WORSE than WE spend our money!

The above being said, CRG may sometimes determine that a proposal is a "responsible proposal for taxpayer determination". That means that both of the criteria above has been met. CRG does NOT promote referendums. The organization has an abiding faith in THE PEOPLE to ultimately decide such issues. But the organization knows they may only intelligently decide such issues if they have complete, relevant, and truthful information given them in any election determination. THAT is what Citizens for Responsible Government (CRG) works to ensure.

Locations

Citizens for Responsible Government (CRG) was founded in Gurnee, Illinois in late 1997 by eight community leaders in the Warren/Newport Twp. areas. Since then, it has grown organically to include various organizations that are not chapters, per se, but affiliated CRG organizations in Lake Bluff, Libertyville, and Lake Zurich Illinois.

Additional to these Lake County locations, our organization has be co-opted by like-minded individuals in Wisconsin and, most recently, Indiana.

Start a CRG Affiliate !

Any individual of similar, taxpayer-sensitive mind is free to start their own chapter. Ken Arnold would be happy to provide you a free copy of our By-Laws that you may adapt for your needs. Additionally, Ken Arnold is available to consult, for a modest fee, the further development of such organization (i.e. patterns for membership cards, sample press releases for conceptual ideas on tax matters, political campaign consulting, etc.). For modest expense, there is also available a full functioning "autocall" capability to get your message out to voters or conduct polling questions with them.

It has been our experience after sixteen years in existence that taxpayers have increasingly relied upon our legwork, monitoring of taxing bodies, and analysis of local tax issues of the day. There has also been favorable movement by taxing bodies, knowing there's a "sentinel in town", to operate more responsibly on a day-to-day basis and to even try to adapt their initiatives in order to be seen by CRG as a "responsible proposal for voter determination".

The days of local schools, libraries, and villages pulling the wool over the eyes of taxpayers with half-truths, excuses, and "smoke and mirrors accounting" are over where an organization like Citizens for Responsible Government has been in place for an extended period of time. Even the media likes writing articles on referendums where they're now able to get a ready "alternative perspective" on any proposal.

Citizens for Responsible Government (CRG)

Promoting public discussion and debate...

![]()

| Name | |

| Title | |

| Company | |

| Address | |

| Phone |